Understanding ECN Forex Trading: A Comprehensive Guide

ECN (Electronic Communications Network) Forex trading is a modern approach to currency trading that leverages technology to facilitate direct transactions between buyers and sellers in the forex market. Unlike traditional trading methods that rely on market makers, ECN trading connects traders through a network of liquidity providers and offers a more transparent trading environment. In this article, we will delve into the nuances of ECN trading, discussing its various aspects, including its benefits, operation mechanisms, and how traders can take advantage of it. You can find a reliable trading platform to start your journey in the forex market through ecn forex trading Trading Platform HK.

What is ECN Forex Trading?

ECN Forex trading allows traders to execute their orders in real-time without the interference of a broker. Rather than dealing with a market maker who takes the opposite position on trades, ECN systems match orders from various participants in the market. This offers a more competitive pricing environment, reduces the spreads, and increases the speed of execution.

How Does ECN Forex Trading Work?

The ECN model enables different market participants to interact directly through an electronic network. Here’s how the process generally works:

- Order Formation: A trader places an order via their trading platform. This order can be to buy or sell a currency pair.

- Order Matching: The ECN system matches the buy and sell orders based on the best available prices from various participants in the network.

- Execution: Once a match is found, the order is executed almost instantaneously, ensuring the trader gets the desired price.

Advantages of ECN Forex Trading

ECN Forex trading has numerous advantages that appeal to both novice and experienced traders. Some of the key benefits include:

1. Increased Transparency

One of the defining features of ECN trading is its transparency. Traders have access to deeper liquidity, and they can see all active buy and sell orders in real-time. This visibility helps in making more informed trading decisions.

2. Lower Spreads

ECN trading typically offers lower spreads compared to traditional market maker models. Because orders are matched according to supply and demand, competition among liquidity providers can lead to tighter spreads that are more favorable for traders.

3. Direct Market Access

Traders benefit from direct access to the interbank forex market, which allows them to execute trades at market prices without any delay or intervention from brokers.

4. No Requotes

In a traditional trading environment, traders may experience requotes—situations where a broker alters the price of a trade after it’s been submitted. In contrast, ECN trading minimizes this risk, ensuring that the trader receives the price they expected at the time of order placement.

Challenges of ECN Trading

While ECN trading has significant advantages, it is not without its challenges. Here are some considerations traders should be aware of:

- Monthly Fees: Many ECN brokers charge a monthly fee for access to their network, which can eat into profits, especially for smaller traders.

- Higher Initial Capital: ECN trading usually requires a higher initial deposit compared to other types of trading accounts. This can be a barrier for some traders just starting out.

- Market Volatility: While ECN trading offers direct market access, it can also expose traders to greater volatility. Rapid changes in market conditions can lead to slippage or unexpected losses.

Who Should Consider ECN Forex Trading?

ECN trading is particularly suitable for those who are comfortable with technology and have experience in trading. This includes:

- Scalpers: Due to the lower spreads and faster execution, scalpers can maximize their profits by entering and exiting trades quickly.

- Professional Traders: Experienced traders who use advanced trading strategies can leverage the benefits of ECN trading for improved results.

- High-Frequency Traders: Those who engage in high-frequency trading will find ECN solutions particularly appealing, as they require quick execution and competitive pricing.

Getting Started with ECN Forex Trading

If you’re interested in getting started with ECN Forex trading, follow these steps:

- Choose a Reputable Broker: Research brokers that offer ECN accounts, comparing their fees, spreads, and overall trading conditions.

- Open an ECN Account: After selecting a broker, you will need to open an ECN trading account. Be prepared to fund it with the required minimum deposit.

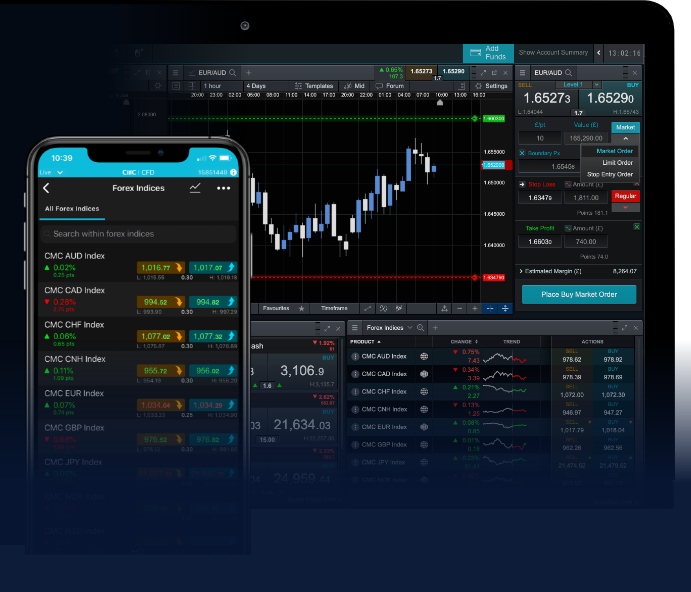

- Use a Trading Platform: Utilize the broker’s trading platform to place your buy and sell orders. Familiarize yourself with its features, including charts, indicators, and order types.

- Develop a Trading Plan: Create a robust trading strategy that takes into account your risk tolerance, financial goals, and trading style.

- Start Trading: Begin trading by executing your strategy while closely monitoring market conditions and adjusting as necessary.

Conclusion

ECN Forex trading offers a compelling alternative to traditional trading methods, providing traders with direct access to the market, lower costs, and greater transparency. While it may not be suitable for everyone, particularly novice traders, those with experience and the proper risk management strategies can leverage its benefits for potential profitability. As the forex market continues to evolve, exploring the possibilities that ECN trading offers could be a game changer for many traders.